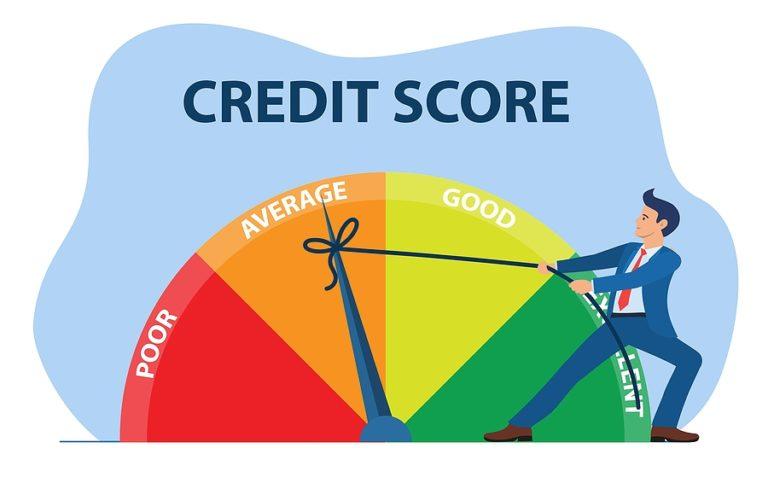

Missing loan payments can affect your credit in many ways. Here is the process of how late payments work:

Late payments are reported on day 30, 60, 90, 120, 150, and 180, which are negative marks on your credit score. At this point, the account is charged off. A charge-off is another new negative mark on your credit.

Once a collections agency is notified that creates a new mark.

All these negative marks can remain on your credit report and negatively affect your credit for 7 years.